Reliable Consolidation and Financial Management Reporting Software

Automate and Streamline Your Consolidated Management Reporting Process

"*" indicates required fields

How Efficient is Your Financial Close Process?

Lack of Unified Data Model

The consolidation process is complex. Using multiple software solutions can complicate things even further, particularly when you separate financial consolidation from financial management. Without a single source of truth, data becomes error-prone and introduces potential risk into your consolidation process.

Manual Tasks Waste Time

When too much time is spent on data collection and reconciling intragroup and intercompany transactions, this lengthens the financial close cycle. Manually auditing consolidated accounts is complex and forces users to focus on low-value tasks rather than spending time on value-added analysis.

Current Solution is too Limited and Rigid

Existing solutions are not collaborative or scalable. With limited analysis capabilities, they are unable to adapt quickly to support changing business needs.

Trusted By

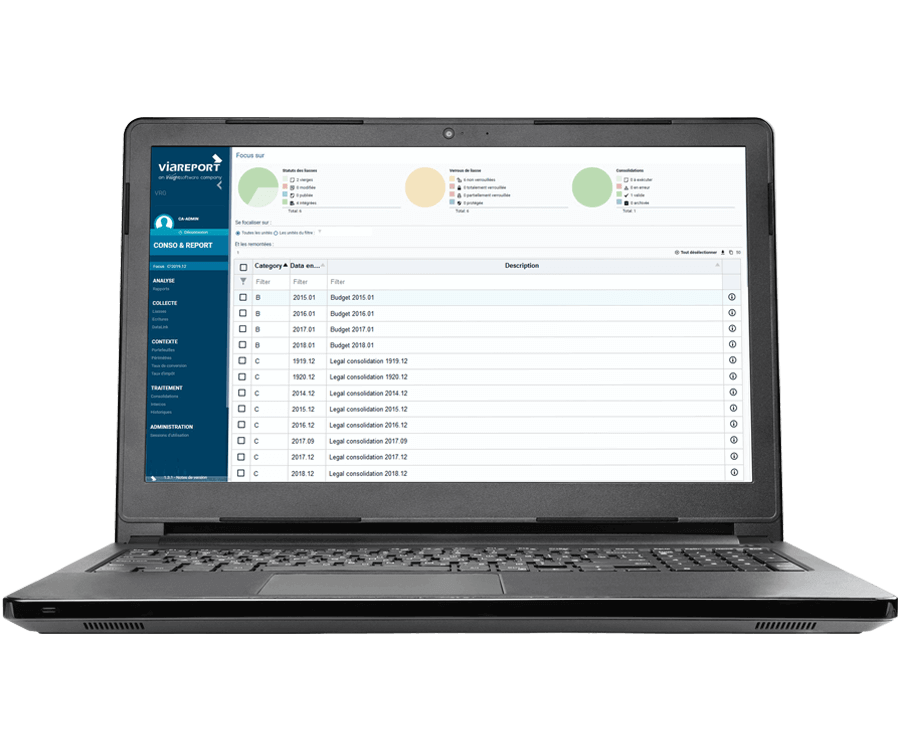

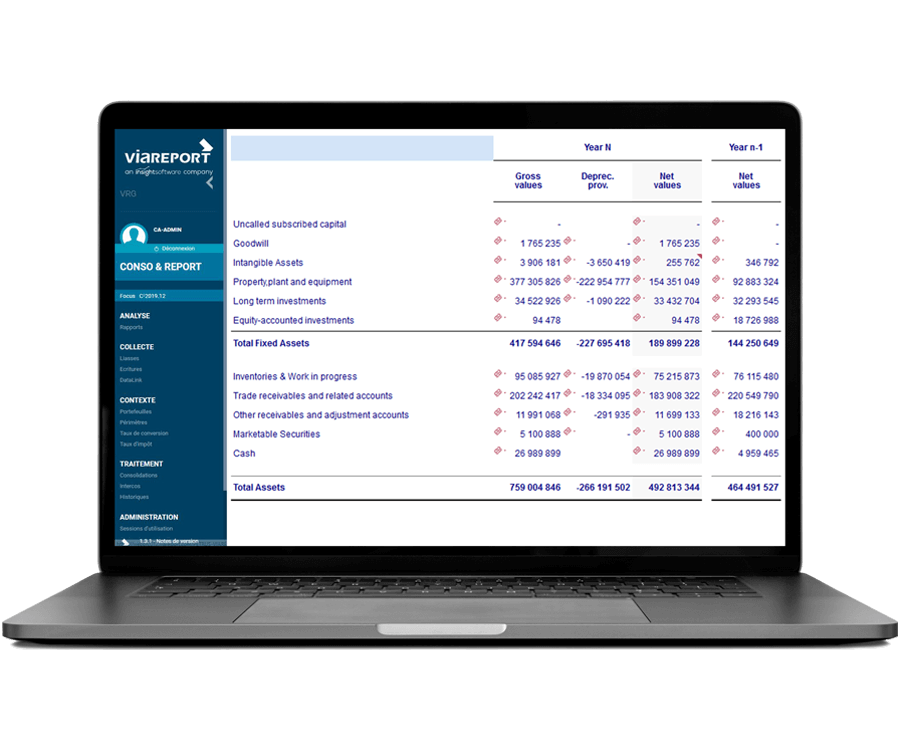

Utilize a Single Source of Truth

Viareport provides a single source of truth for data. This reduces errors and inconsistencies, and through real-time intragroup reconciliation, ensures your data is always up to date and accurate. A single source of data allows you to create custom analyses while providing a consistent basis for reporting, budgeting, planning, and forecasting activities.

Accelerate the Consolidation Process

Viareport reduces time and manual efforts by automatically interfacing with accounting tools. It is a scalable solution with built-in consistency checks and automated processing that eliminates manual tasks and ensures correct and accurate data. This allows for a more efficient, streamlined approach to consolidation.

Collaborate with Stakeholders

Viareport Consolidation is a collaborative cloud application that makes it easy to engage relevant stakeholders at each stage of the consolidation process. It comes with a user-friendly interface and workflows to orchestrate the activities of users from the group and its subsidiaries, notifying them when they need to take action.

BEST-IN-CLASS FEATURES

Single Source of Truth

Ensure your consolidation process is reliable

- Work with one application that supports multiple processes, including statutory consolidation, monthly reporting, and budgeting.

- Unified data model ensures accurate, consistent, and reliable data.

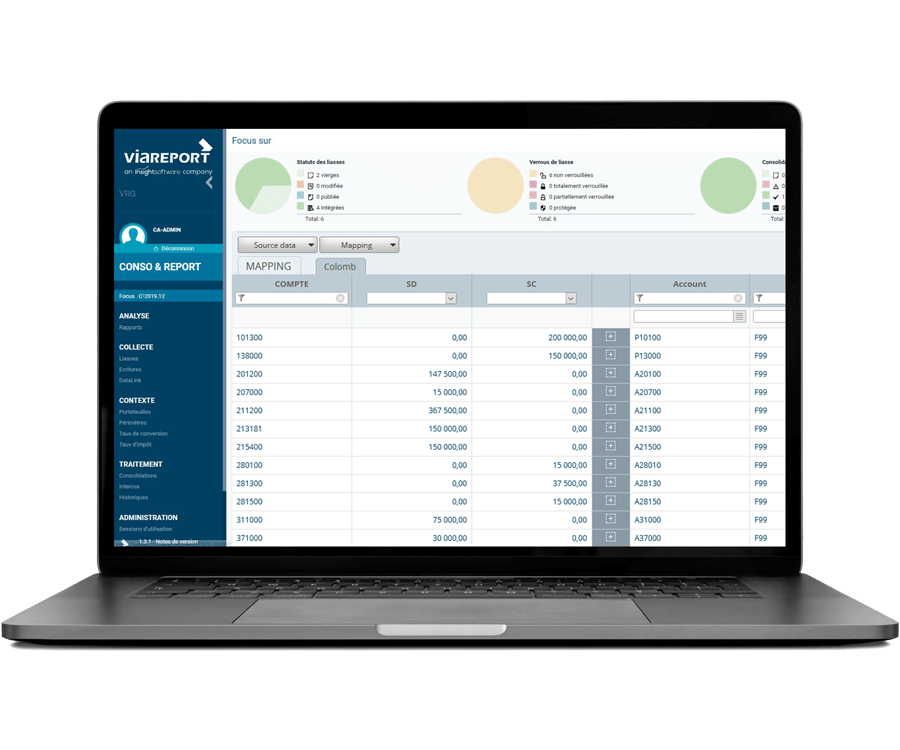

Automated Interface

Accelerate the production of your consolidated accounts

- Automatically interface with data from upstream systems.

- Import data from correspondence tables in Excel.

- Manage large volumes of data.

- Reduce time and manual effort on menial tasks and redirect time to analyzing more accurate data.

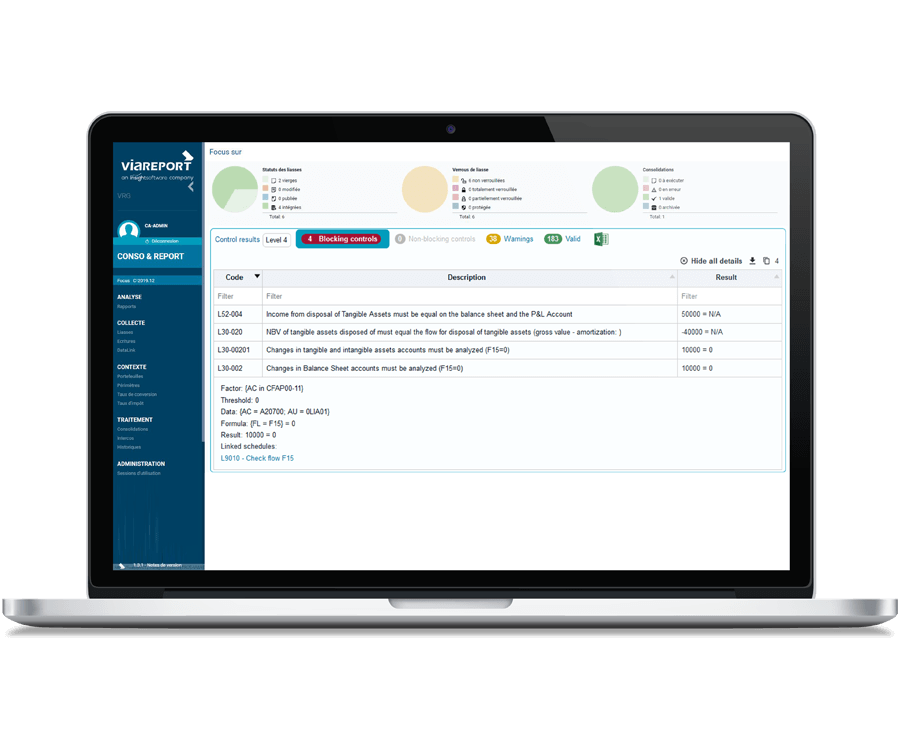

Reliable Reporting

Ensure your consolidation process is reliable and accurate

- Consistency checks ensure your consolidation process is more reliable.

- Audit trails provide additional transparency.

- Determine the frequency of your reporting cycle based on your company’s needs.

- Accurate reporting enables users to anticipate, manage, and measure group performance at regular intervals.

Collaborative Software

Work with a variety of team members and stakeholders at each stage

- Cloud software enables collaboration amongst users.

- Profiles are tailored to each user’s needs.

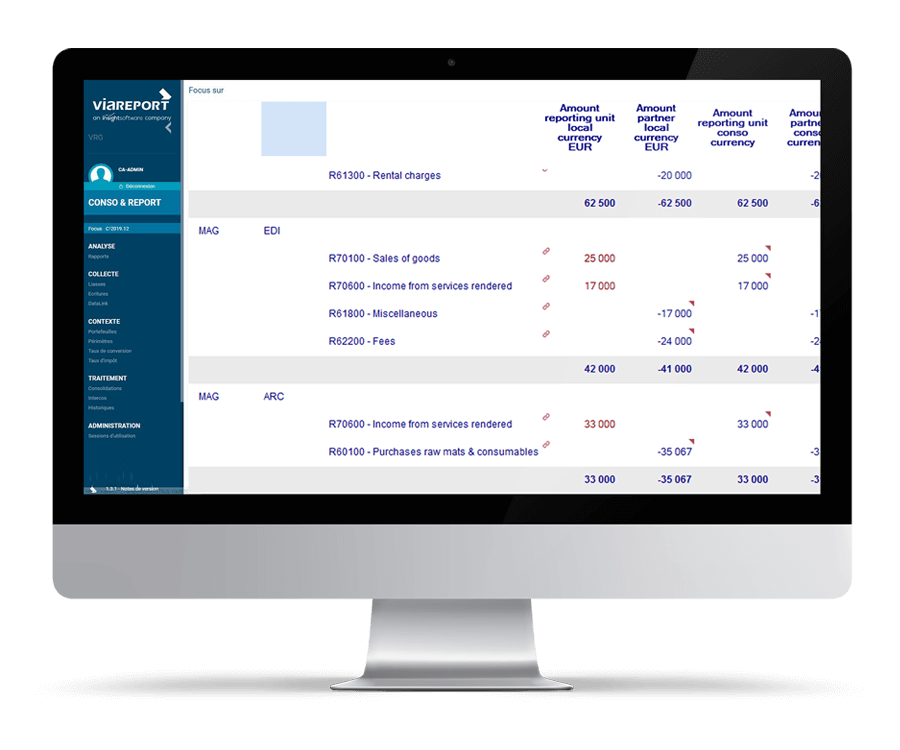

- Real time intragroup reconciliation.

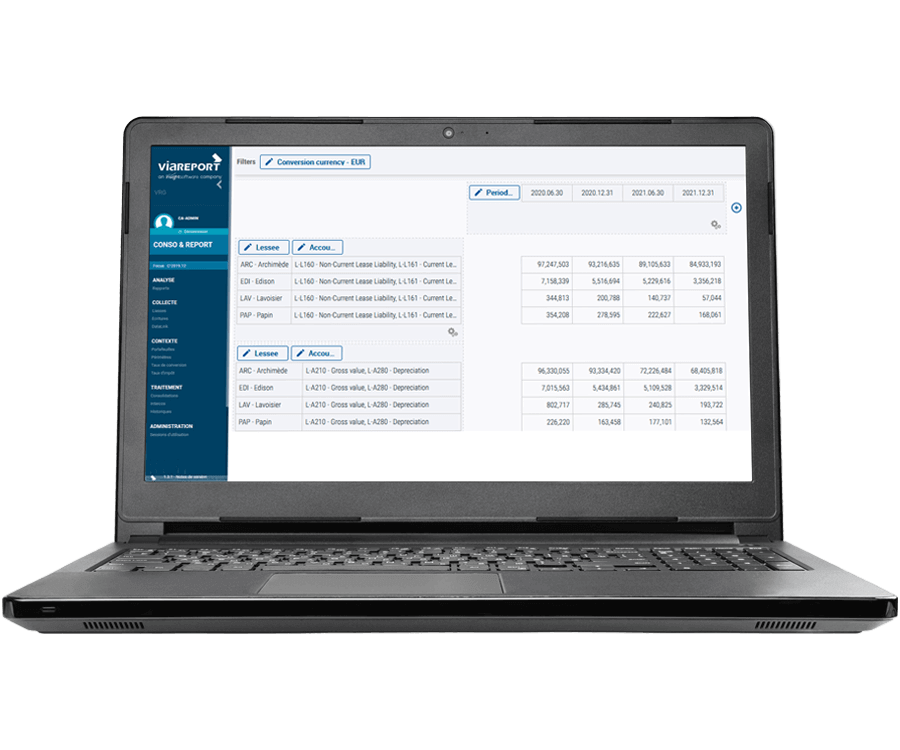

Flexible Analysis

Monitor a variety of indicators for accurate analysis

- Analyze data across multiple dimensions including department, subsidiary, product, and cost center.

- Analyze variances between actual and forecast results.

- Perform comparisons across differing exchange rates, scopes, etc.

- Consolidate different hierarchies (organizational, managerial, geographic, etc.) to get a clear view of performance.

Proven Expertise

Trust an expert in cloud consolidation

- Used by over 600 groups and accounting firms as well as 5000 users.

- Expert in the field since 2005.

Work with the #1 Reporting Vendor for ERPs and EPMs

We wanted a simple tool. Prior to this, we were only producing a combination of accounts in Excel for PMU. We needed an intuitive reliable solution that would provide an audit trail to show the origin of each item of data. As our consolidation is audited, it was vital for us to see the relationship between the data entered and consolidated amounts.

Speak to an Expert